How I Lost $13,000 "Investing" in Two Crypto Ponzi Schemes

Anyone who knows me would say I'm a big fan of crypto. Over the last few years, I've gotten more and more into the space, to the point where I own dozens of NFTs, I've lent money through DeFi, and most of the tweets I see are from fellow enthusiasts.

But when you get really into crypto, a few strange things can start to happen:

- You start to hear real stories of people like you getting fantastically rich.

- You start getting exposed to more "esoteric" "investment opportunities" that are way outside of mainstream crypto investments like Bitcoin and Ethereum.

- You start to believe (maybe as a result of a few trading successes) that you are "early" on the ideas and projects you're seeing, which leads you to dream that maybe it is actually possible that the thing you're thinking of investing in could be the next Solana or Luna and you'll get rich and then be sitting on a yacht somewhere.

Enter me about two months ago. On the back of a few small crypto investing wins, I started hearing more and more about something called OlympusDAO, which is building "The Decentralized Reserve Currency":

Some people (including me) say that Bitcoin is "digital gold" that serves as a store of value, and therefore will be used as a reserve currency in addition to its other uses (eg. transferring money). This project claimed that Bitcoin was not built for this purpose, and they had invented a better mechanism for a coin that would be a "backed" store of value supported by a basket of assets.

I don't want this post to get too technical, but essentially Olympus invented a mechanism whereby users can "stake" (aka deposit) the OHM token in exchange for very high levels of interest - at the time, it was about a 7000% APY. Contrast that with the approximately 0% you would receive by putting your money in a bank account and you can understand why that might be attractive.

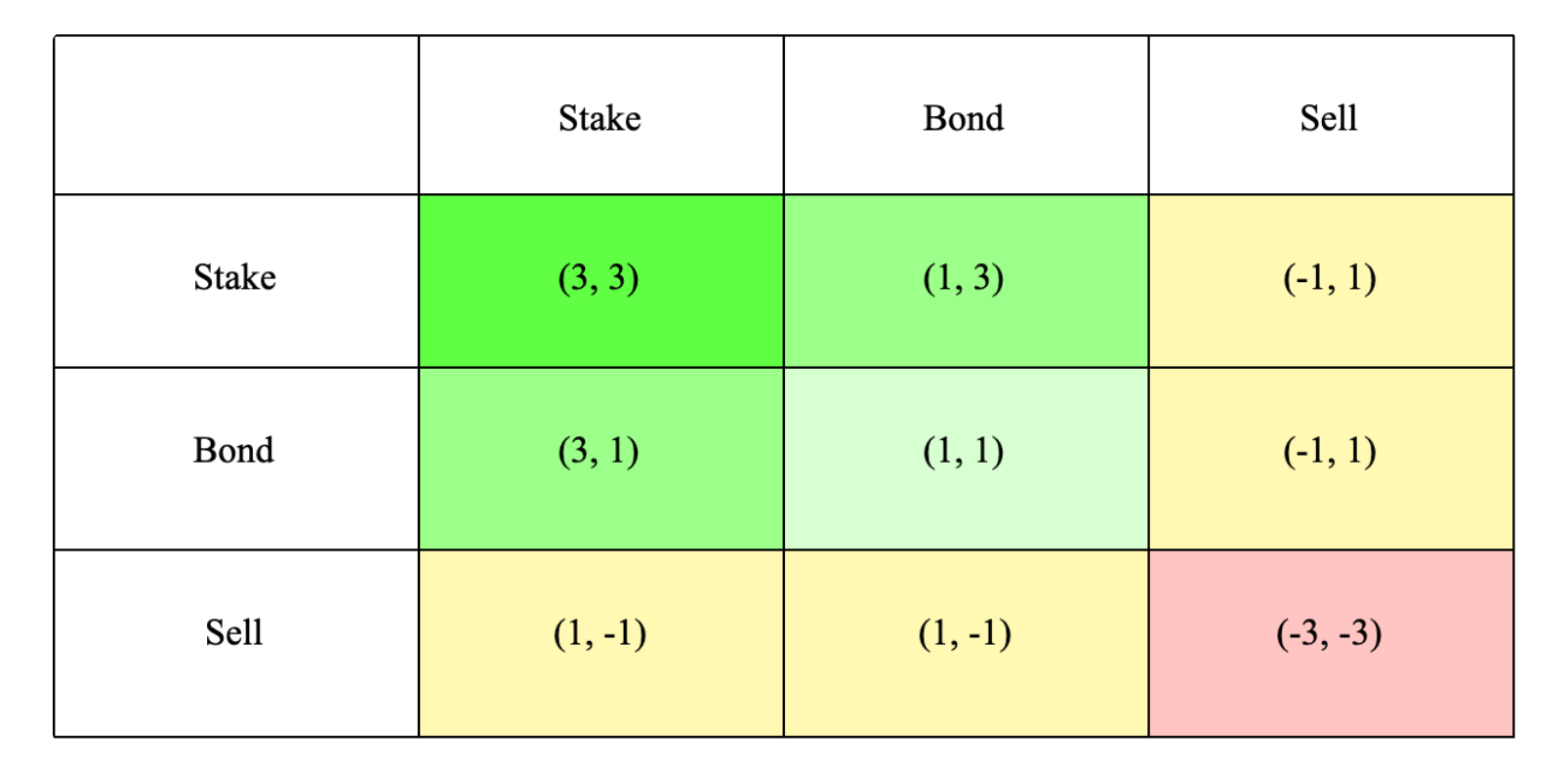

The catch is that the interest is paid in the form of OHM tokens. Since staking props up the value of the token, investors are incentivized to keep their tokens staked. This incentive has become known as "(3,3)" or alternatively "(🎩,🎩)" - essentially, it means that theoretically, everyone should want to stake and therefore everyone should benefit:

There is a lot more to it, much of which is explained in Olympus's very detailed FAQ. But to summarize, I came away with the impression that Olympus had created something that was at least somewhat innovative in the crypto space, and as a result, some people were earning a lot of money in it. I was hearing it mentioned on podcasts, in Telegram chats, and especially on YouTube:

When you combine all this together, there should have been alarm bells ringing in my head telling me, "This is too good to be true". Instead, the combination of all these signals and "social proof" made me think, "This might collapse eventually, but maybe I'm early enough to still make money."

In early November 2021, I ultimately decided to invest $16,000 into Olympus and another similar project called Time Wonderland. I'm sharing the actual amount because I believe that people should be way more transparent about the actual dollar value of their investments, especially their investment mistakes. Amounts make money real. In my case, I am very fortunate to have profited from other crypto & NFT investments, so I used money that I had already gained to make this investment.

The calculus was that the insane interest I would earn would offset any declines in price of the OHM and TIME tokens. But As it turns out, there is no such thing as a free lunch.

As soon as I bought in, it became evident that I had entered at a peak in the market. Without many new investors, there was no continued appreciation of the underlying tokens. I was truly earning insane APYs....but the value of the tokens I was earning was eroding every day.

Eventually, the value of both OHM and TIME had dropped 90% from when I bought in. TIME also experienced a massive scandal because one of their founders had been involved in a previous crypto scam. I capitulated and sold out my positions, because I came to believe that they ultimately would go to zero, and some value was better than none. I walked away with about $3,000 which I feel lucky to still have.

A Ponzi scheme is defined on Wikipedia as:

"a form of fraud that lures investors and pays profits to earlier investors with funds from more recent investors."

Whether or not Olympus and Wonderland are technically Ponzi schemes is a matter of great debate even among extremely knowledgeable crypto investors. However, I don't believe it's debatable that they have ponzi-esque economics, because they have no reason for existing other than to try to return a high APY to investors.

Unlike Bitcoin, Ethereum, or many other crypto projects, OHM and TIME are not actually solving problems. They are simply mechanisms that you can earn a yield from, without any clear reason why you should earn that yield. The only thing supporting these setups are funds from new investors and hype.

This was a learning experience that I'm very thankful did not have a more significant financial impact. I take away the following:

- Do not invest any money in crypto that you cannot afford to lose.

- Crypto projects that have no applications/no reason to exist will eventually go to zero.

- Most of the time, you are not early - and you shouldn't depend on being early in order to have a successful investment.

I haven't given up taking risks on early crypto projects or staking in general. To me, a lot of crypto is an asymmetric bet that can pay off really well with minimal downside.

David McIntyre Newsletter

Join the newsletter to receive the latest updates in your inbox.